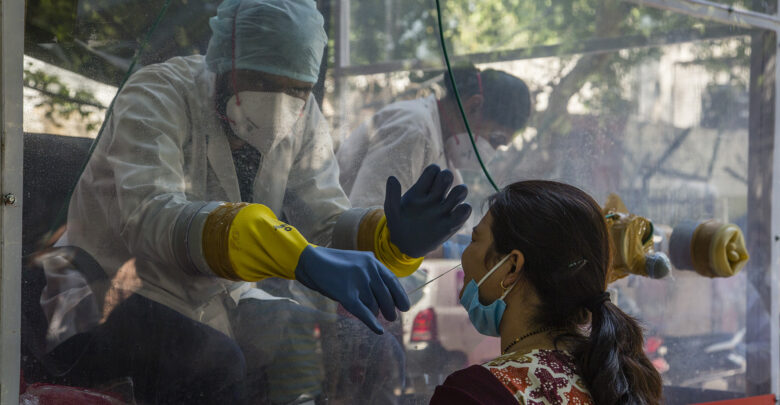

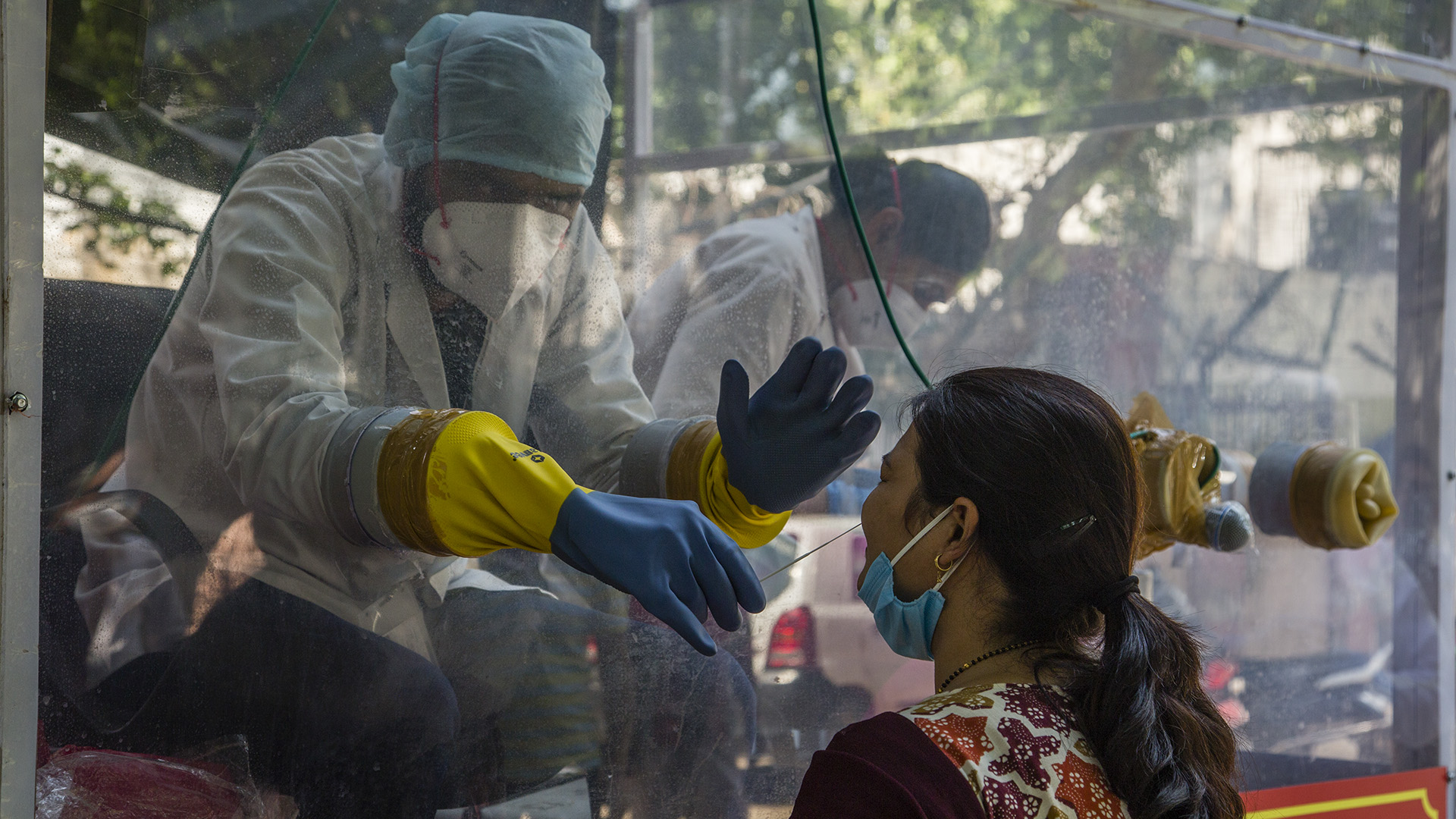

SINGAPORE — India’s second coronavirus wave will affect its infrastructure sectors to varying degrees with power companies and ports better able to weather the impact of pandemic-induced disruptions compared with airports and toll roads, according to a new report by Moody’s Investors Service.

Any further regional lockdowns would increase uncertainty over India’s economic recovery, said the report. While infection rates are declining, vaccination rates remain low, leaving open the risk of subsequent infection waves that can bring further lockdowns.

The report said that the government’s ability to limit the virus spread and materially increase its vaccination drive will have a direct impact on the economic recovery.

“Many states in India have reimposed regional lockdowns as daily new cases increased sharply in May,” said Abhishek Tyagi, Vice-President and Senior Credit Officer, Moody’s.

“The lockdowns along with public behavioral changes are curbing economic activity and mobility, which will have a varied impact on infrastructure companies.”

Among the sectors most severely affected by movement restrictions are airports and toll roads whose liquidity buffers will be key for their credit quality.

“Lower cash revenue can pressure debt-funded expansion projects of rated airports which can need additional debt to complete their projects,” said Spencer Ng, Vice President and Senior Analyst, Moody’s.

“Nevertheless, recent capital raisings by airports have provided some liquidity buffers.”

In contrast, Moody’s-rated power companies can manage the current demand contraction and elongated cash conversion cycle, given their good access to liquidity and sponsors that can provide financial support.

Likewise, rated ports are well-positioned to handle any medium-term slowdown in cargo volumes, given their dominant market share and material buffer in their financial profiles to absorb temporary disruptions.

“Despite the pressure points, the industrial sector has already started recovering,” Ajay Chaudhary, Chairman and Managing Director, Ace Group, said.

But the industry can derive its optimism from the recent report of the Reserve Bank of India, “State of the Economy.”

In the report, the Reserve Bank has stated that industrial production and exports have surged amid the pandemic protocols. As per the report, despite the second wave, goods and services tax (GST) collection in 2021-22 so far has been better than in 2020-21.

“The real estate sector has been following all the Covid protocols with maximum use of digital tools since the first wave of the pandemic. Moreover, the vaccination drive has also made considerable headway. The investor sentiment is also bullish on the back of the availability of ready-to-move-in or nearing completion inventories at low prices. Looking at all these factors, we can easily ascertain, real estate sector is set to achieve high growth, and it hopes for a gallop.”

Meanwhile, as the industry has now geared up for recommencement of economic activities in a gradual manner, the veterans of the industry including real estate, pharma, healthcare, education, power, furniture, steel tubes, hospitality, and legal sector are of the opinion that now the worst is over and the industry is well on the path of gradual recovery.

(With inputs from ANI)

(Edited by Anindita Ghosh and Amrita Das)

The post India’s Second Covid Wave To Impact Infra Sectors: Moody’s appeared first on Zenger News.